Fails to handle really serious budgeting concerns: A funds-borrowing application could temporarily solve a more serious problem together with your budget and paying habits. How to check income-borrowing apps

Fees for bank card dollars advancements are notoriously large, so even For those who have a credit card, that’s probably not your best option.

Smart Money analyzes your expending and tends to make investing or cost savings deposits based on your allocations, which some people may not want. You'll be able to, nonetheless, flip off Clever Cash once you aren’t using Quick.

When you finally’ve calculated regular monthly payments and curiosity fees, it’s time to compare bank loan features and use. Here’s what’s subsequent:

4. Apply Most personalized bank loan lenders Allow you to utilize online, and also you’ll know straight away in case you’re accepted or not. After you apply and obtain authorized, you can take mortgage conditions and put in place banking information.

Enter your desire amount. Your individual financial loan fascination amount is predicated totally on your credit rating profile and fiscal facts. Fantastic-credit rating borrowers with minimal financial debt-to-earnings ratios frequently get the bottom premiums.

Review lender options. The personal loan with the bottom charge and cost-effective regular monthly payments is usually the best financial loan supply. In case you have several promising features, Evaluate Exclusive options to break the tie. Some lenders have credit-setting up equipment, unemployment defense or quickly funding.

If you have a bank card, you could possibly withdraw a $200 dollars advance or make use of your credit history line to protect an urgent price. But in case you don’t Have got a credit card or adequate credit history to qualify for just a loan, these will not be feasible solutions.

Hard cash advances is usually capped at a handful of hundred to some thousand check here dollars, Nonetheless they’re quick and simple to acquire. In case your charge card provides a PIN, just pay a visit to an ATM to withdraw.

Assess your choices, determine just how much it can Expense and weigh the advantages and disadvantages of cash-borrowing apps to make a decision whenever they’re greatest in your case.

Very best credit rating cardsBest reward give credit cardsBest stability transfer credit rating cardsBest vacation credit history cardsBest cash back credit score cardsBest 0% APR credit score cardsBest rewards credit score cardsBest airline credit history cardsBest college university student credit score cardsBest bank cards for groceries

Car coverage guideAuto coverage ratesBest car coverage companiesCheapest vehicle insurancePolicies and coverageAuto insurance plan critiques

A home fairness loan is often a type of lump-sum loan generally generally known as a 2nd mortgage, as you may be generating payments on your regular home loan in addition to a home fairness bank loan concurrently when repayment starts.

Overall interest payments: The level of fascination you shell out over the life of the financial loan. This amount doesn’t include the origination cost.

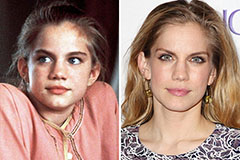

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!